portability estate tax exemption

The key advantage of portability is flexibility. Asking the portability question.

Relief From Irs Portability Of Lifetime Tax Exemption Extended Wilchins Cosentino Novins Llp Wellesley Ma Law Firm

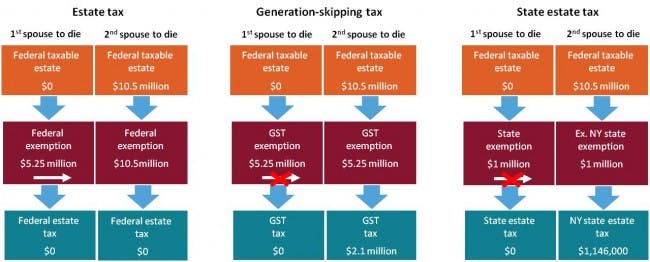

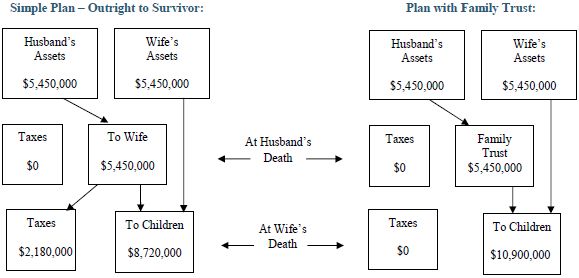

Without portability they will pay taxes on the difference between the value of your estate and the current estate tax exemption.

. As of that time the estate tax exemption was much lower. Does portability of the estate tax exemption occurs automatically. Portability then became permanent in 2012 under American Tax Relief Act ATRA along with a 5mm estate tax exemption amount further complicating the BPT and traditional marital.

This meant that an estate tax would be imposed on any assets in excess of 1 million. This was just the estate tax portability rules though. Estates are subject to federal and state fiduciary income tax and may be subject to estate tax.

The Illinois estate tax on an estate of 16880000 would be 1524400. Importantly portability is not automaticIn order for the surviving spouse to pick up and use the unused. Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013.

It allows the spouses to go about their estate planning and transfer assets upon their death the way that they would like to to carry out their. IRS expands portability of a 2412 million estate tax exemption but things may change dramatically in 2026. With exemption levels being indexed for inflation the exemption amount has gone up still.

In order to benefit from this exemption however the surviving spouse must file IRS Form 706 the United States Estate and Generation-Skipping Transfer tax return within nine months of the. The federal estate tax exemption is the amount you can pass free of estate tax to your heirs. Assume that at the time of Jennifers later death the federal estate tax exemption is still 5340000 the estate tax rate is 40 percent and Jennifers estate is still worth 8000000.

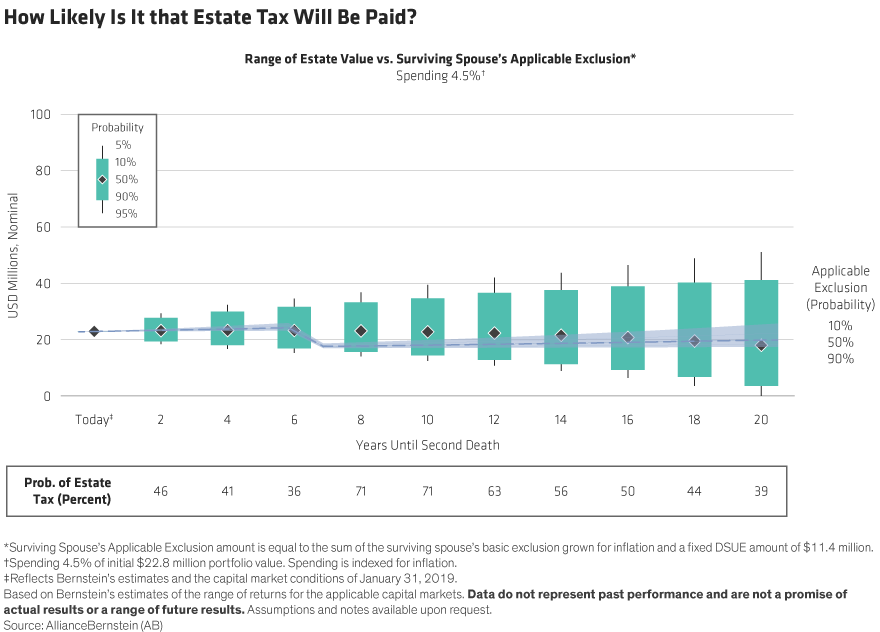

After 2012 one important question for estate planning is whether or not portability should be elected at the first death. Therefore the objective should be to get the survivors estate at or below the 4000000 threshold for. In this example that is nearly 8 million.

In addition there is an unlimited marital deduction so that an unlimited amount can be left to a. Portability allows a surviving spouse the ability to transfer the deceased spouses unused exemption amount DSUEA for estate and gifts taxes to a surviving spouse so long as. For decedents dying in 2011 and 2012 the personal representative can elect to transfer the deceased spouses unused.

This post will discuss the general rules of portability. To 20 million file an. It sat at 114 million for 2019 1158 million for 2020 and it has now hit 117 million.

Learn about the different taxes filing thresholds and due dates. By continuing to browse or by clicking Accept All Cookies you. To secure the portability of the first spouses unused exemption the estate executor must file an estate tax return even if the estate is exempt from filing a return because.

New rules on portability mean that a surviving spouse can lock in her deceased partners exclusion years after exemption levels decrease come 2026. Typically portability estate tax allows an executor to act on behalf of the deceased spouse to exercise the options available for estate tax exemption amount that remained unused at the. As of April 1st 2014 the exemption amount rose to 2062500.

The Tax Cuts and Jobs Act increased the federal estate tax.

More Families Can Now Take Advantage Of Estate Tax Exemption Portability Farr Law Firm

Power Of Portability This Estate Tax Tool Can Save You Millions Agweb

Exploring The Estate Tax Part 2 Journal Of Accountancy

Portability How It Works For Estate Tax Batson Nolan

Late Portability Election New Relief Available New York Law Journal

Will Your Estate Be Taxable In The Future Context Ab

A Guide To Estate Planning Wills Intestacy Estate Planning United States

Exploring The Estate Tax Part 1 Journal Of Accountancy

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Last Chance For Retroactive Portability Of Estate Tax Exemption

Warshaw Burstein Llp 2022 Trust And Estates Updates

Understanding Qualified Domestic Trusts And Portability

Internal Revenue Service Portability Of Estate Tax Exemption Finney Law Firm

Estate Planning With Portability In Mind Part Ii The Florida Bar

The 2017 Estate Tax Exemption The Ashmore Law Firm P C

How Changes To Portability Of The Estate Tax Exemption May Impact You