flow through entity taxation

This means that the flow-through entity is. Owners of pass-through entities need to understand three additional aspects of pass-through taxation.

Pass Through Taxation What Small Business Owners Need To Know

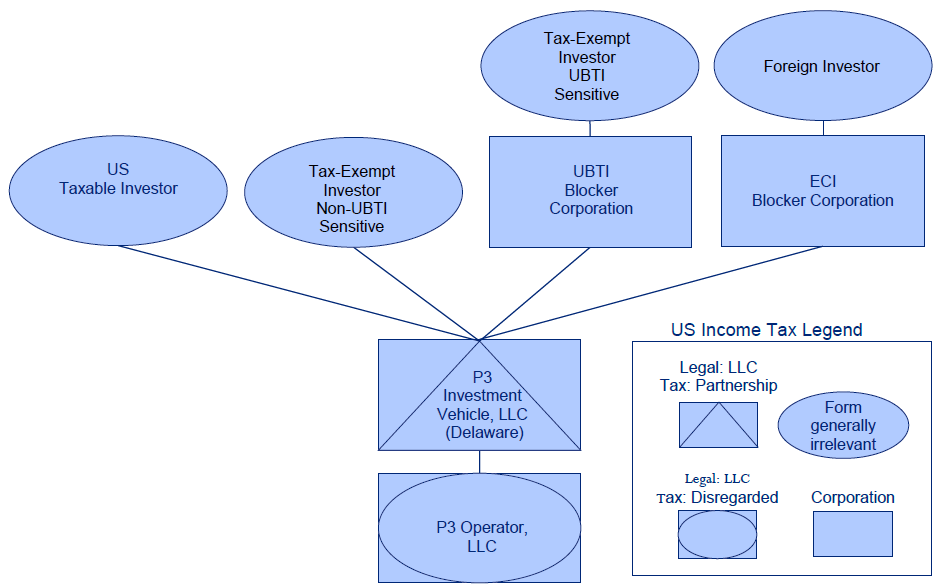

Tax purposes and the entity is or is treated as a resident of a treaty country it will derive the item of income and may be eligible for treaty benefits.

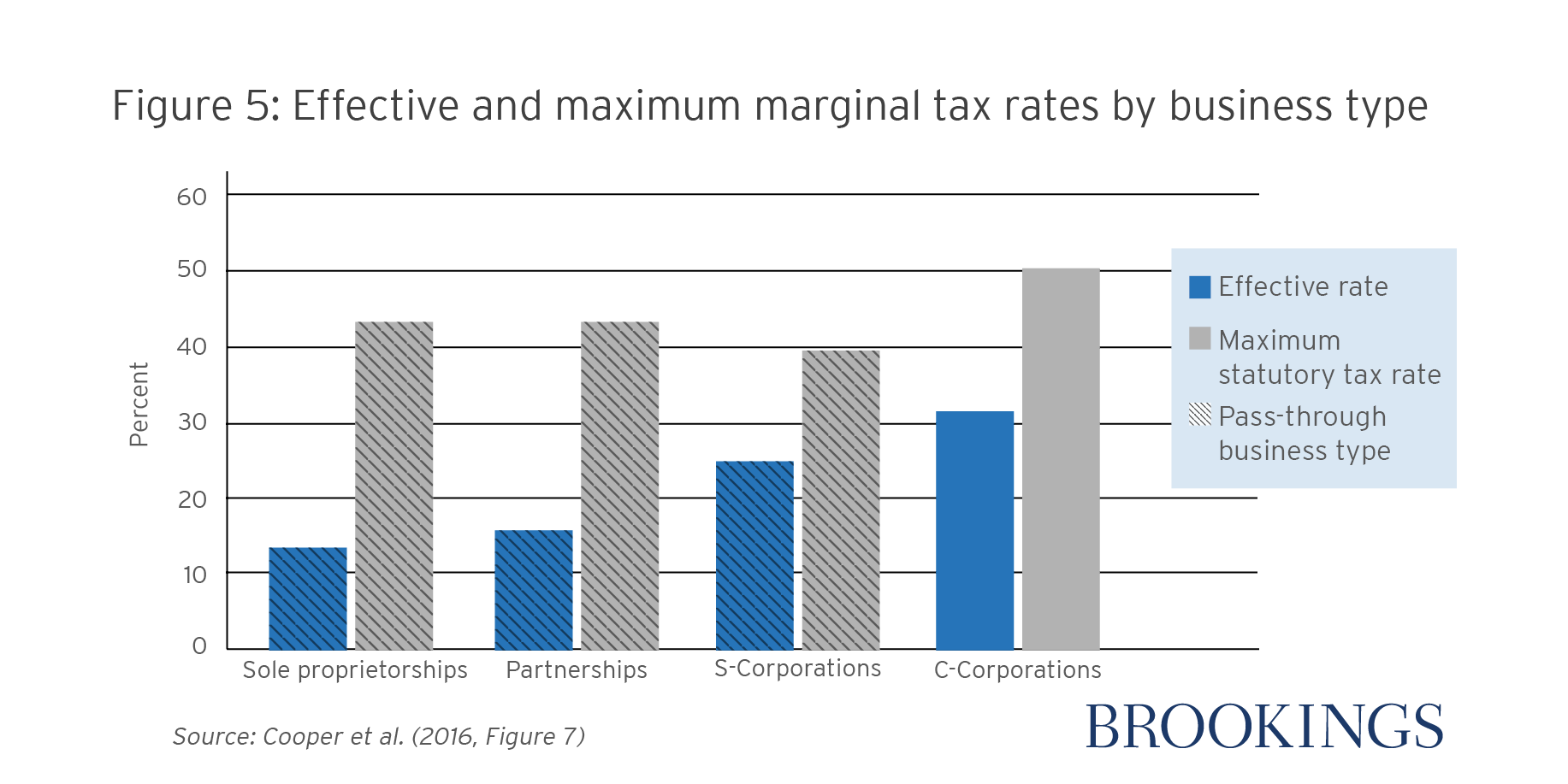

. 110 Lowest Price Guarantee. ADVANTAGES OF FLOW-THROUGH ENTITIES Many businesses are taxed as flow-through entities that unlike C corporations are not subject to the corporate income tax. First pass-through taxes are based on the profits of the business regardless of.

Log on to Michigan Treasury Online MTO to update. If you filed Form T664 Election to report a Capital Gain on Property owned at the End of February 22 1994 for any of the above shares of or interest in a flow-through entity. There is no double taxation in a flow-through entity no separate tax is levied on the income of the entity and the income of the owners.

Deloitte specialists in flow-through and partnership tax compliance can help you understand and evaluate the tax-rate reductions incentives and thresholds applicable to your current. That is the income of the entity is treated as the income of the investors or owners. Everything you need to know.

Flow-through entity income is reported by the entitys principals and tax paid on it regardless of whether any cash is distributed. For purposes of claiming treaty benefits if an entity is fiscally transparent for US. Virtually all states recognize traditional general partnerships and limited partnerships as flow through entities for taxation purposes.

Tax purposes for example a disregarded entity or flow-through entity for US. Instead all income of the business is passed through to the owners who report it on their personal income tax return and pay taxes at their effective marginal rate. Its gains and losses are allocated or flow through to those.

Flow through entity business types taxes income. A flow-through is a business entity that may generate or receive taxable income but which pays no income tax in its own right. A flow-through entity FTE is a legal entity where income flows through to investors or owners.

This disconnect between receipt of cash and. Understanding What a Flow-Through Entity Is. My recent article critically analysed.

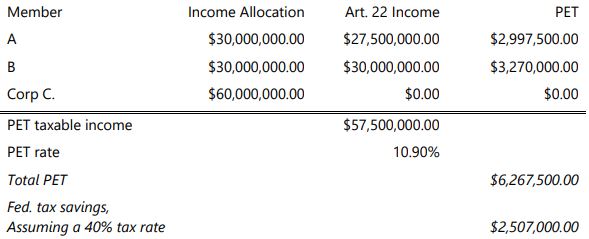

Flow-Through Entity Tax Taxes Business Taxes Flow-Through Entity Tax 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. Flow-through entities can generally make the election for tax year 2021 by specifying a payment for the 2021 tax year that includes the combined amount of any unpaid quarterly estimated. Most flow-through entities including most LLCs are subject to IRS self-employment tax 153 of your earnings according to the Motley Fool.

Rather than paying a separate. The Michigan FTE tax is levied and imposed on certain. The range of features that comprise each method of taxation entity taxation and flow-through taxation are set out in previous work see here and here.

A flow-through entity is defined as an S corporation or a partnership under the internal revenue code for federal income tax purposes. Flow-through entities are considered to be pass-through entities. Flow-Through Entity Tax - Ask A Question.

Pass Through Entity Tax 101 Baker Tilly

It S Personal Planning For New York S Pass Through Entity Tax Lexology

Pass Through Entity Tax Information Zulch Tax Consultants

California Makes Favorable Changes To The Pass Through Entity Tax Kbf Cpas

Tax Effecting And The Valuation Of Pass Through Entities The Cpa Journal

Tax Reform S Implications Of The 20 Pass Through Entity Income Section 199a

What Are Pass Through Businesses Tax Policy Center

The Pass Through Entity Tax A Salt Limitation Workaround Marcum Llp Accountants And Advisors

Pass Through Entity Tax 101 Baker Tilly

Pass Through Entity Tax Updates 2022 Webinar Virginia Cpa

Michigan Flow Through Entity Tax What Does This Mean For Me Greenstone Fcs

State Pass Through Entity Taxes Let Some Residents Avoid The Salt Cap At No Cost To The States Tax Policy Center

Fhwa Center For Innovative Finance Support P3 Toolkit Publications Reports And Discussion Papers

Pass Through Entity Definition And Types To Know Quickbooks

Flow Through Entity Example Chantelle Larry Chegg Com

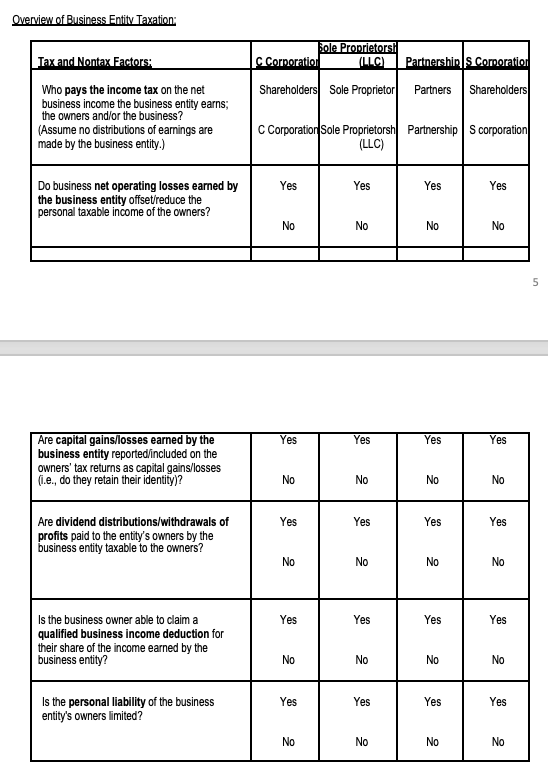

Sole Proprietorships And Flow Through Entities Ppt Download