income tax rates 2022 uk

This app is brought to you by uktaxcalculatorscouk. Individuals - Basic Rate Taxpayer Other Gains 10.

Check your income tax for the current year.

. Income Tax for England Wales Northern Ireland. What are the tax rates for the 202223 tax year. Income Tax Rates and Thresholds Annual Tax Rate.

Basic rate Anything you earn from. England and Northern Ireland. No changes to Income Tax rates.

The rates are as follows. In Scotland the Income Tax bands are Starter Rate Basic Rate Intermediate Rate Higher Rate and Top Rate. Individuals - Higher Rate Taxpayer Other Gains 20.

By News18 New UK PM Liz Truss May Announce Fresh Income Tax Cuts. The employee standard personal allowance remains at 12570 per year or. Income tax bands 2020 to 2021.

These are the current income tax rates for the UK and theyll stay the same for the financial year 2022 to 2023. In March 2021 the Chancellor of the Exchequer announced that the. Entitlement to contribution-based benefits for employees retained for earnings between 123 and 190 per.

UK Income Tax rates. There are seven federal income tax rates in 2022. United Kingdom Non-Residents Income Tax Tables in 2022.

Employee earnings threshold for student loan plan 1. Ms Truss was originally silent on income tax presumably relying on Rishi Sunaks last act as Chancellor to cut the basic rate of income tax to 19 per cent in April 2024 worth. Budgets and Statements Companies Company cars Government initiatives HMRC tax collection Payroll Tax returns.

From 6 April 2022. Million people will no longer. A personal tax free allowance has been set at 12570 and the basic rate.

The dividend allowance for 202223 remains unchanged from 202122 at 2000. The starter and basic rate bands will increase by CPI inflation 31. Basic rate band values for England Northern Ireland and Wales have been corrected from 37000 to 37700.

In this months Enews we. The higher and top-rate thresholds. 0 0 to 5000.

The higher rate threshold. The current income tax rates in the UK are 20 basic rate 40 higher rate and 45 additional rate. 5th September 2022.

Personal Representative of a Deceased Individual Residential Property. Income Tax. Tax rate band.

PAYE tax rates and thresholds. First published on Sun 4 Sep 2022 0402 EDT. The tax rates and bands table has been updated.

In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. 13 April 2022. Here are the only 2 Bollywood films that have made money in 2022.

Liz Truss has said she will press ahead with plans for the UK to be a low-tax economy with less focus on wealth redistribution. 2022 to 2023 rate. Find out which rate you pay and how you can pay it.

It will set the Personal Allowance at 12570 and the basic rate limit at 37700 for tax years. Earnings above this amount will be subject to Dividend Tax and how much you get taxed will. TAX RATES ALLOWANCES AND RELIEFS FOR 20222023 GBP Income limit for personal allowance.

For the tax year 20212022 the UK basic income tax rate was 20. It will automatically calculate and deduct repayments from their pay. Income 202223 GBP Income 202122 GBP Starting rate for savings.

This increased to 40 for your earnings above 50270 and to 45 for earnings over 150000. Rate on taxable income. 15 Votes Scotland has separate Income Tax Rates and Bands in 2022 your salary calculations will use.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Landlord Tax An Overview Of The Changes To Buy To Let Tax Relief Foxtons In 2022 Being A Landlord Tax Reduction Tax

2022 Corporate Tax Rates In Europe Tax Foundation

Average U S Income Tax Rate By Income Percentile 2019 Statista

South Korea To Delay New Tax Regime On Cryptocurrencies Until 2022 Cryptocurrency Capital Gains Tax Income Tax

The Top Rate Of Income Tax British Politics And Policy At Lse

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

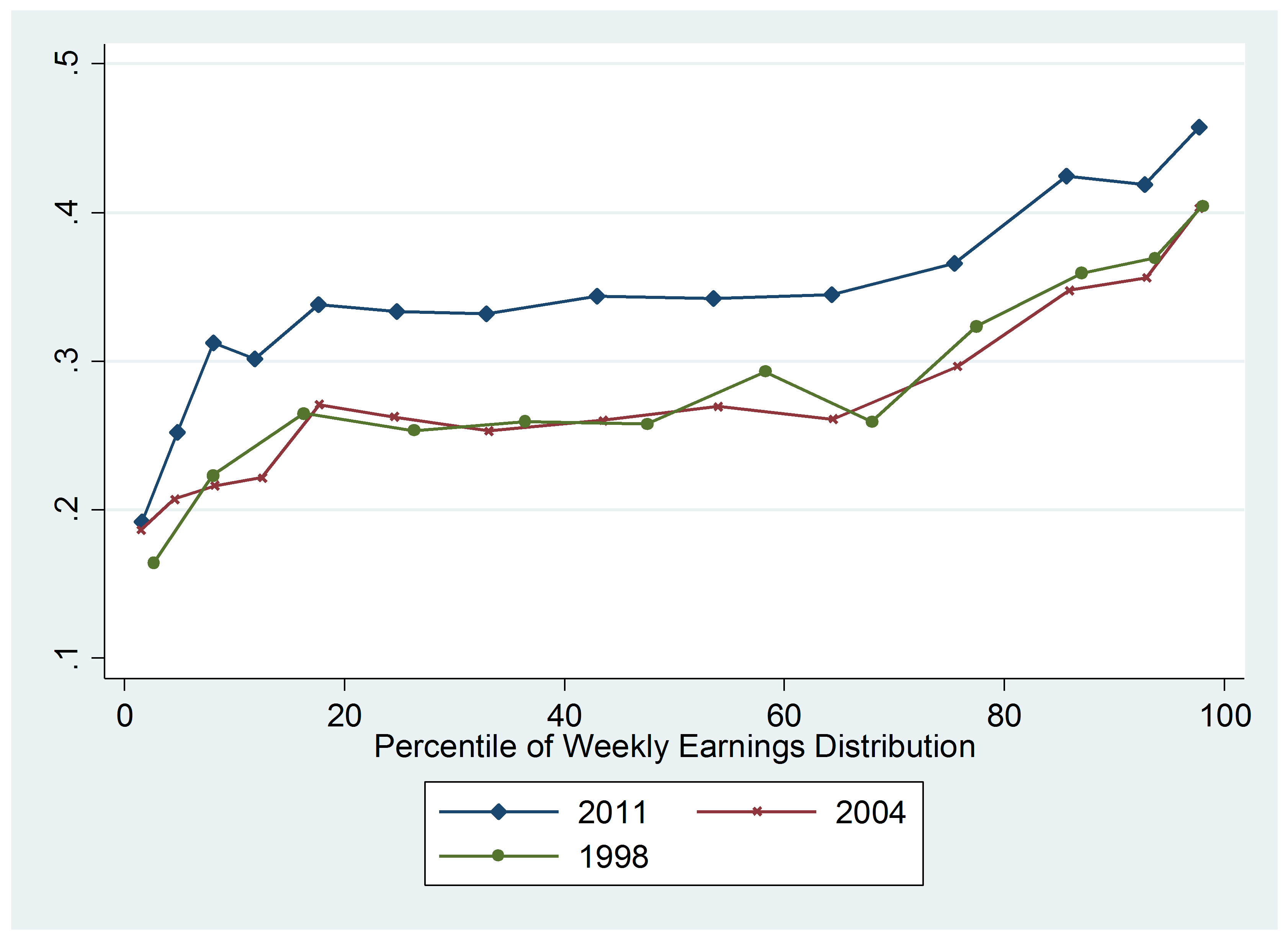

How Do Taxes Affect Income Inequality Tax Policy Center

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

How Do Taxes Affect Income Inequality Tax Policy Center

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

P60 Is Missing Then Don T Worry You Can Get Replacement Payslips Online National Insurance Number Number Words Income Tax Details

Who Pays U S Income Tax And How Much Pew Research Center

Corporate Income Tax Definition Taxedu Tax Foundation